FORCE DEVELOPERS

STRATEGIC OBJECTIVES 2018-2020

OUR MISSION

The Swiss Force Investment Fund for Emerging Markets will be the development finance institution of the Africa Confederations. Force Investment promotes long-term, sustainable and broad-based economic growth in developing and emerging countries by providing financial support to commercially viable small and medium-sized companies (SMEs) as well as fast-growing enterprises which in turn helps to create secure and permanent jobs and reduce poverty.

The Swiss Federal Council Will Support the strategic objectives from FORCE, which serve as guidelines for investment activities.

FORCE investments strategic 2018-2020 makes FISSD.

FiSSD { SWISS Force Investments in Sustainable Development }

Strategic areas of focus

FORCE Investment Sustainable Africa Development:

– Will be- a important instrument for fostering private sector development in developing and emerging countries, complementary to other measures of the eco- nomic development assistance

– Will - promotes sustainable and inclusive growth in developing and emerging countries as well as their integration into the global economic system;

– Will - focuses on the creation and maintenance of more and better jobs as well on the im- provement of working conditions and skills, recognizing that more and better jobs are the main driver of poverty reduction as well as social inclusion in developing and emerging countries and that they offer an alternative to irregular migration. In this way, FORCE Decision-Makers helps to fight the root-causes of irregular migration and contributes to- wards the mandate of Parliament to strategically link international cooperation with the migration issue;

– Will - promotes the development of sustainable business in developing and emerging coun- tries, based on internationally recognized environmental, social, and governance standards;

– Will - contributes to strengthening resilience of these countries, inter alia against climate change;

– Will - Strives to meet the highest standards of integrity, transparency, and professionalism, resulting in a strong strategies reputation and recognition in the general public.

Offering, performance, impact

FISSD will carry out investments that produce a specific and verifiable development impact through the promotion of viable and dynamic SMEs and fast growing compa- nies in the private sectors of the target countries. This entails first and foremost the creation of more and better jobs as well as the diversification and strengthening of the local financial markets or financial intermediaries, improvement in the management of the portfolio companies and their better access to external finance, increased tax rev- enues at the investment locations etc.;

FISSD will ensure a balance among development effects, portfolio liquidity, regular income, and risk diversification by deploying various investment instruments.

FISSD can invest in the following types of vehicles:

Responsible investment is an approach to investing that aims to incorporate environmental, social and governance (ESG) factors into investment decisions, to better manage risk and generate sustainable,long-term returns. ESG encompasses a wide range of issues, and many of these issues are dynamic. They include:

ENVIRONMENTAL STANDARDS

The Swiss Force Investment Fund for Emerging Markets will be the development finance institution of the Africa Confederations. Force Investment promotes long-term, sustainable and broad-based economic growth in developing and emerging countries by providing financial support to commercially viable small and medium-sized companies (SMEs) as well as fast-growing enterprises which in turn helps to create secure and permanent jobs and reduce poverty.

The Swiss Federal Council Will Support the strategic objectives from FORCE, which serve as guidelines for investment activities.

FORCE investments strategic 2018-2020 makes FISSD.

- FISSD will be an important instrument for fostering private sector development in developing and emerging countries, complementary to other measures of the economic development assistance;

WE promotes sustainable and inclusive growth in developing and emerging countries as well as their integration into the global economic system; - FISSD focuses on the creation and maintenance of more and better jobs as well on the improvemen jobs are the main driver of poverty reduction as well as social inclusion in developing and emerging countries and that they offer an alternative to irregular migration.

- FISSD promotes the development of sustainable business in developing and emerging countries, based on internationally recognized environmental, social, and governance standards;

contributes to strengthening resilience of these countries, inter alia against climate change;

Strives to meet the highest standards of integrity, transparency, and professionalism, resulting in a strong reputation and recognition in the general public.

INVESTMENT PRINCIPLES

- Leverage: FISSD, through its investments, seeks to optimise the flow of additional capital from private and other institutional investors for the benefit of its

- Subsidiarity: FISSD provides financing that is either unavailable on the market or not available at reasonable terms and conditions, or in sufficient amounts or maturity.

- Complementarity/Additionality: makes investments that not only fill a gap in financing but also add tangible value, notably in the form of know-how transfers and the provision of technical support to funds and portfolio companies.

- Sustainability: FISSD adheres to the basic principles of financial, economic, social and environmental sustainability in its investments activities.

Strategic areas of focus

FORCE Investment Sustainable Africa Development:

– Will be- a important instrument for fostering private sector development in developing and emerging countries, complementary to other measures of the eco- nomic development assistance

– Will - promotes sustainable and inclusive growth in developing and emerging countries as well as their integration into the global economic system;

– Will - focuses on the creation and maintenance of more and better jobs as well on the im- provement of working conditions and skills, recognizing that more and better jobs are the main driver of poverty reduction as well as social inclusion in developing and emerging countries and that they offer an alternative to irregular migration. In this way, FORCE Decision-Makers helps to fight the root-causes of irregular migration and contributes to- wards the mandate of Parliament to strategically link international cooperation with the migration issue;

– Will - promotes the development of sustainable business in developing and emerging coun- tries, based on internationally recognized environmental, social, and governance standards;

– Will - contributes to strengthening resilience of these countries, inter alia against climate change;

– Will - Strives to meet the highest standards of integrity, transparency, and professionalism, resulting in a strong strategies reputation and recognition in the general public.

Programme-related areas of focus on FISSD .

– Sustainability: In its investment activity, FISD will observe the basic principles of fi- nancial, economic, social and environmental sustainability.

– Financial Additionality: FISSD will provide finance that cannot be obtained from the private capital markets (local or international) with reasonable terms or quantities and for similar developmental purposes without official support.

– Value Additionality: FISSD offers to recipient entities or mobilizes, alongside its in- vestment, non-financial value which is supplementary to the private sector and which will lead to better development outcomes, e.g. by providing or catalyzing knowledge and expertise, promoting social or environmental standards or fostering good corpo- rate governance or skills development.

– Leverage effect: FISSD will mobilize additional capital for the target countries or the beneficiary companies from the private sector that would not have otherwise invested. To this end, in accordance with its mandate, FISSD will bear a portion of the political or commercial risks and conversely will share the risks and returns from the invest- ments with the private and institutional investors.

– Geographic concentration: FISSD will concentrate its activities on the priority coun- tries and regions of Swiss development cooperation. To a lesser extent other devel- oping and emerging countries according to the current list of the Development Assis- tance Committee of the OECD are also eligible for investment, if they show a per cap- ita GNP less than the threshold for IBRD categorization which is defined annually by the World Bank5.

– Sustainability: In its investment activity, FISD will observe the basic principles of fi- nancial, economic, social and environmental sustainability.

– Financial Additionality: FISSD will provide finance that cannot be obtained from the private capital markets (local or international) with reasonable terms or quantities and for similar developmental purposes without official support.

– Value Additionality: FISSD offers to recipient entities or mobilizes, alongside its in- vestment, non-financial value which is supplementary to the private sector and which will lead to better development outcomes, e.g. by providing or catalyzing knowledge and expertise, promoting social or environmental standards or fostering good corpo- rate governance or skills development.

– Leverage effect: FISSD will mobilize additional capital for the target countries or the beneficiary companies from the private sector that would not have otherwise invested. To this end, in accordance with its mandate, FISSD will bear a portion of the political or commercial risks and conversely will share the risks and returns from the invest- ments with the private and institutional investors.

– Geographic concentration: FISSD will concentrate its activities on the priority coun- tries and regions of Swiss development cooperation. To a lesser extent other devel- oping and emerging countries according to the current list of the Development Assis- tance Committee of the OECD are also eligible for investment, if they show a per cap- ita GNP less than the threshold for IBRD categorization which is defined annually by the World Bank5.

Offering, performance, impact

FISSD will carry out investments that produce a specific and verifiable development impact through the promotion of viable and dynamic SMEs and fast growing compa- nies in the private sectors of the target countries. This entails first and foremost the creation of more and better jobs as well as the diversification and strengthening of the local financial markets or financial intermediaries, improvement in the management of the portfolio companies and their better access to external finance, increased tax rev- enues at the investment locations etc.;

FISSD will ensure a balance among development effects, portfolio liquidity, regular income, and risk diversification by deploying various investment instruments.

In this context, FISSD may use the following:

o Loans and other debt instruments (such as secured or unsecured loans, junior debt, debt instruments convertible into equity or tied to investment securities);

o Equity or quasi-equity instruments; and

o Guarantees to cover equity participations and to help borrowers gain access to fi- nancing.

o Loans and other debt instruments (such as secured or unsecured loans, junior debt, debt instruments convertible into equity or tied to investment securities);

o Equity or quasi-equity instruments; and

o Guarantees to cover equity participations and to help borrowers gain access to fi- nancing.

Alternative investments funds: Investments in specialized risk capital vehicles as well as mezzanine and debt funds;

Financial institutions: Investments in local financial institutions and financial inter- mediaries that grant medium to long-term financing primarily to SMEs but also to microfinance institutions and infrastructure projects;

Private companies (as long as commensurate with the FISSD risk policy).

FISSD will be an active investor by participating whenever possible in the governing bodies of its investments, to be able to contribute expertise, address challenges and opportunities on sustainability issues, and ensure compliance with core elements of Swiss development assistance policy.

FISSD enables with adequate measures the direct mobilization of private and institu- tional investors in order to grow the investment volume and increase the development impact. These co-investment resources complement the investment capital of the Swiss Confederation as well as the leverage effect at the level of funds and in the tar- get countries respectively.

In accordance with the current practice of European development financing institu- tions, FISSD continually monitors the development impact mentioned under a throughout the entire investment cycle.

Financial institutions: Investments in local financial institutions and financial inter- mediaries that grant medium to long-term financing primarily to SMEs but also to microfinance institutions and infrastructure projects;

Private companies (as long as commensurate with the FISSD risk policy).

FISSD will be an active investor by participating whenever possible in the governing bodies of its investments, to be able to contribute expertise, address challenges and opportunities on sustainability issues, and ensure compliance with core elements of Swiss development assistance policy.

FISSD enables with adequate measures the direct mobilization of private and institu- tional investors in order to grow the investment volume and increase the development impact. These co-investment resources complement the investment capital of the Swiss Confederation as well as the leverage effect at the level of funds and in the tar- get countries respectively.

In accordance with the current practice of European development financing institu- tions, FISSD continually monitors the development impact mentioned under a throughout the entire investment cycle.

FISSD submits a separate annual report on this impact for the attention of SECO as representative of the Swiss Confederation as well as for the interested general public.

Positioning, development

– FISSD will position its investment activities as contribution to the target outcomes (“Wirkungsziele”) of Switzerland’s economic development cooperation framework, look for synergies and ensure coherence with that framework, while factoring in the crosscutting themes of gender equality and sound economic governance.

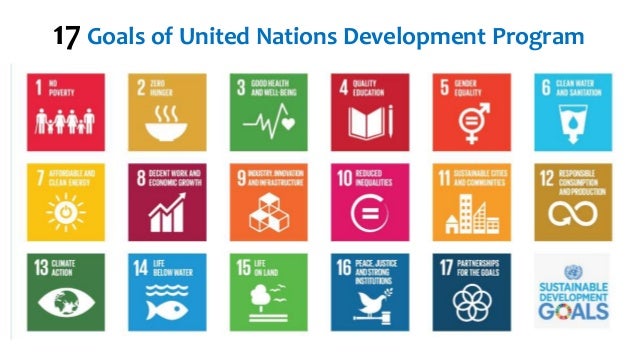

– FISSD focuses in the implementation of the Agenda 2020 for Sustainable Devel- opment of the United Nations by way of its investment activities and the mobilization of finance from the private sector.

– within the framework of its statutory mandate and taking into account the financial ob- jectives, FI will aim at maximizing the development impact of its investments. While all investments must be economically viable and contribute to economic devel- opment, it is expected that some investments specifically contribute to foster social inclusion (enabling affordable access to goods, services and jobs for poor- er/disadvantaged segments of the local economies) and/or towards the provision of global public goods, in particular climate protection6 as well as healthcare, education, food security and basic infrastructure.

– FISSD focuses in the implementation of the Agenda 2020 for Sustainable Devel- opment of the United Nations by way of its investment activities and the mobilization of finance from the private sector.

– within the framework of its statutory mandate and taking into account the financial ob- jectives, FI will aim at maximizing the development impact of its investments. While all investments must be economically viable and contribute to economic devel- opment, it is expected that some investments specifically contribute to foster social inclusion (enabling affordable access to goods, services and jobs for poor- er/disadvantaged segments of the local economies) and/or towards the provision of global public goods, in particular climate protection6 as well as healthcare, education, food security and basic infrastructure.

Risk policy and risk management

– FISSD will operate a specific system for the identification, monitoring and manage- ment of both its investment and operational risks as well as conduct regular analysis and control reviews and refine them as required.

– FISSD will not take on any excessive financial risks in the development of additional sources of income or in its liquidity management.

– FISSD will hold liquid assets that provide sufficient cover for those commitments that have been entered into but not yet released.

– FISSD is appropriately insured against liability risks.

– FISSD will not take on any excessive financial risks in the development of additional sources of income or in its liquidity management.

– FISSD will hold liquid assets that provide sufficient cover for those commitments that have been entered into but not yet released.

– FISSD is appropriately insured against liability risks.

Financial Objectives Investments

FISSD will target a positive rate of return for each investment.

FISSD will achieve an annual rate of return of greater than 3 percent and an annual value multiplier of greater than 1.15 at the portfolio level7.

For the reporting at the end of the strategy period, FISSD will make comparisons with similar investment vehicles in respect of the performance.

Cooperation Arrangements

FORCE investments will participate in appropriate networks and alliances of organizations with similar objectives insofar as this helps to achieve the strategic objectives.

Adaptation of the Strategic Objectives

Within the valid period the Federal Council can we adapt the strategic objectives as required. It will make decisions on their adaptation following consultation with the Board of Directors of FISSD.

FISSD will target a positive rate of return for each investment.

FISSD will achieve an annual rate of return of greater than 3 percent and an annual value multiplier of greater than 1.15 at the portfolio level7.

For the reporting at the end of the strategy period, FISSD will make comparisons with similar investment vehicles in respect of the performance.

Cooperation Arrangements

FORCE investments will participate in appropriate networks and alliances of organizations with similar objectives insofar as this helps to achieve the strategic objectives.

Within the valid period the Federal Council can we adapt the strategic objectives as required. It will make decisions on their adaptation following consultation with the Board of Directors of FISSD.

Reporting

FORCE INVESTMENTS expects FISSD to submit a written report to it, simultaneously and sup- plementary to the annual business report on the achievement of the strategic objectives in the previous year. It will collect the data and performance indicators required for this pur- pose.

In addition, FISSD will hold regular consultations during the course of the year with repre- sentatives of the Confederation, particularly within the framework of the Controlling Meetings and the Portfolio Review Meetings which are held with the SIFEM proprietor at least every half-year.

FORCE INVESTMENTS expects FISSD to submit a written report to it, simultaneously and sup- plementary to the annual business report on the achievement of the strategic objectives in the previous year. It will collect the data and performance indicators required for this pur- pose.

In addition, FISSD will hold regular consultations during the course of the year with repre- sentatives of the Confederation, particularly within the framework of the Controlling Meetings and the Portfolio Review Meetings which are held with the SIFEM proprietor at least every half-year.

FORCE RESPONSIBLE INVESTMENT

Responsible investment is an approach to investing that aims to incorporate environmental, social and governance (ESG) factors into investment decisions, to better manage risk and generate sustainable,long-term returns. ESG encompasses a wide range of issues, and many of these issues are dynamic. They include:

ENVIRONMENTAL STANDARDS

- Environmental standards include:

- Compliance with environmental regulations

- Sustainable use of natural resources

- Avoiding or reducing CO2 emissions

- Avoiding or reducing the pollution of air, water and land

- The production of hazardous and non-hazardous waste is to be avoided

INVESTMENT CYCLE

Kommentare

Kommentar veröffentlichen